British Pound/U.S. Dollar(GBPUSD)FOREX

Cocoa A Bullish Long-Term Trend

Cocoa futures trade on the Intercontinental Exchange (ICE) and is a member of the soft commodity sector of the raw materials asset class. Cocoa is in the same class as cotton, sugar, coffee, and frozen concentrated orange juice, but it does not share similar supply fundamentals. Brazil is the world’s leading sugar, coffee, and FCOJ producer and the fourth top cotton-producing country. While Brazil is the ninth-leading cocoa producer, the lion’s share of annual output comes from West Africa. The Ivory Coast is the leader, with Ghana second, and Nigeria is the fourth top producer, with Cameroon eighth and Sierra Leona tenth.

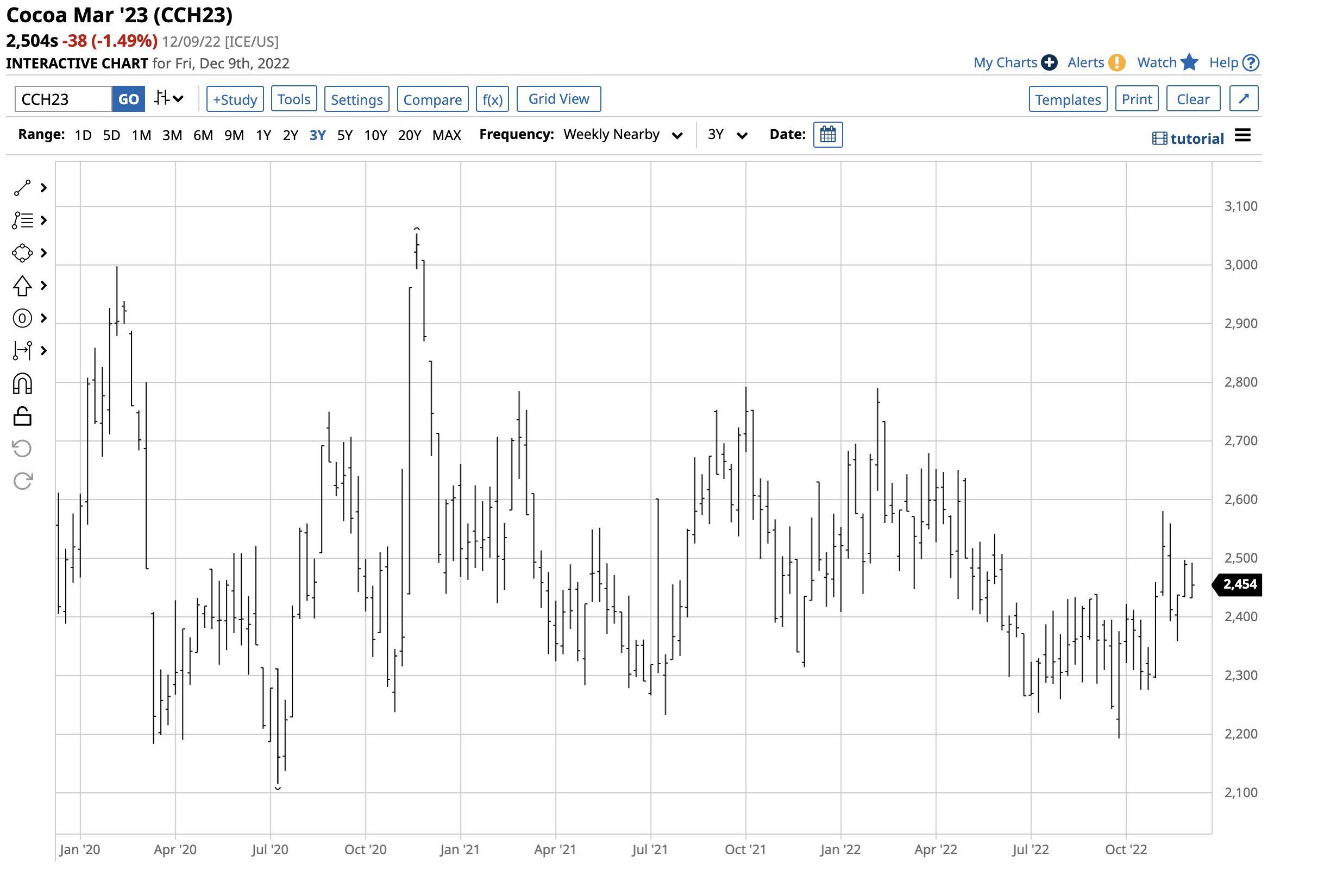

Cocoa has not experienced any significant price volatility in 2022. After probing above the $3,000 level in November 2020, the price action has been sleepy. The iPath Cocoa Subindex TR SM Index ETF product (NIB) tracks ICE cocoa futures higher and lower.

A $598 per ton range in 2022

In 2022, many commodities reached multi-year highs, with some rising to new all-time peaks. Cocoa futures moved in a $598 range, with the low higher than the 2020 bottom and the high below the 2021 peak.

The chart dating back to late 2019 shows the $2,790 high in February 2022 and the $2,192 low during the last week of September 2022. Cocoa was primarily rangebound in 2022, with the price on either side of the $2,400 per ton level. Nearby cocoa futures for March delivery closed at just over the $2500 per ton level on December 9.

A long-term bullish pattern

Cocoa prices have been trending higher since the turn of this century.

The chart dating back to the late 1960s shows that cocoa futures have been chiefly trending higher since reaching $674 per ton in December 2000. Cocoa reached its all-time peak in 1977 at $5,379 per ton. Over the past four and one-half decades, technological improvements and efficiencies in farming and the leading chocolate manufacturers’ support of West African output have caused production to rise and kept output costs under control.

Meanwhile, the long-term chart reveals the bullish bias over the past years, with cocoa futures trading mostly between $2,000 and $3,000 per ton.

Cocoa is sensitive to the British pound

Since West Africa is the leading producer and many chocolate manufacturers have headquarters in Europe, Europe has long been the hub for cocoa trading. Aside from the production-consumption ties, London, an international financial center, has the same time zone as Accra, Ghana’s capital, and Abidjan, the Ivory Coast capital city.

With the U.K. as an international hub of cocoa trading, many physical contracts use the British pound to price cocoa beans and cocoa products. When the pound versus the U.S. currency relationship rises, it tends to put upward pressure on cocoa prices. When the pound declines, cocoa prices often fall. The most recent example was on September 26, 2022, when cocoa for March 2023 delivery dropped to $2,190 per ton, the lowest price since mid-2020.

The chart shows the pound fell to a $1.03485 low against the U.S. dollar on September 26, the lowest level for the currency relationship in thirty-seven years since 1985.

Meanwhile, the pound versus the U.S. dollar relationship reached a high of $2.1161 in November 2007. At that time, cocoa was experiencing a sustained rally that took the price of nearby futures from $674 in 2000 to a high of $3,826 in March 2011. In November 2007, the cocoa futures were rising at the $2,000 per ton level.

Higher lows and higher highs since mid-2017

While cocoa prices consolidated in 2022, the soft commodity’s longer-term trend displays a bullish bias.

The twenty-year chart highlights the cocoa future’s bullish bias as the price has made chiefly higher lows and higher highs since the June 2017 $1,769 per ton low.

While the pound is a critical factor for cocoa prices, the weather in West Africa and political stability in the region determine the path of least resistance of prices each year. Global inflationary pressures and supply chain issues have also impacted the worldwide cocoa market. While inflation in the Ivory Coast was lower than in the U.S. and Europe at 6.3% in November 2022, the rate in Ghana eclipsed 40% in October 2022. Inflationary pressures put upward pressure on all commodity prices, and cocoa is no exception.

Chocolate manufacturers have been working with West Africa on sustainability projects and reducing or eliminating child labor. The leading chocolatiers have paid their West African suppliers a $400 per ton premium for their precious cocoa beans to support adult and reduce child labor. Since over 60% of the world’s cocoa beans come from the region, the premium has supported cocoa prices over the past years.

NIB is the cocoa ETN product

The other soft commodities, including sugar, coffee, cotton, and frozen concentrated orange juice futures, have reached multi-year highs over the past months. It may only be a matter of time before cocoa futures break out to the upside above $2,800 per ton and challenge the $3,000 level.

The most direct route for a risk position in cocoa is via the futures and futures options traded on the Intercontinental Exchange (ICE). The iPath Cocoa Subindex TR SM Index ETF product (NIB) provides an alternative to the futures arena for market participants seeking exposure to the primary ingredient in chocolate.

At $26.96 per share on December 9, NIB had a $15.635 million market cap. NIB trades an average of 14,610 shares daily and charges a 0.70% management fee.

The most recent rally in cocoa took the March futures from $2,190 on September 26, 2022, to a high of $2,577 per ton on November 11, a 17.67% rally.

Over the same period, NIB rose from $23.02 to $27.75 per share or 20.55% as the ETN did an excellent job and outperformed the March futures during the most recent rally.

Cocoa has been in a long-term bullish trend, and I expect it to continue in 2023.

More Softs News from Barchart

- Will a Cotton Market Rally Force the Return of Polyester Clothing?

- Cotton Closes Mid-Range on Friday Gains

- Dollar Strength Knocks Cocoa Prices Lower

- Sugar Prices Undercut by a Slump in Crude Oil

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.